Condo Insurance in and around Gilbert

Townhome owners of Gilbert, State Farm has you covered.

State Farm can help you with condo insurance

- Mesa

- Queen Creek

- Chandler

- San Tan Valley

- Tempe

- Gilbert

- Scottsdale

- Phoenix

- Florence

- Glendale

There’s No Place Like Home

Are you investing in condo ownership for the first time? Or have you been around the block a few times? Either way, it can be a good idea to get coverage for your condo with State Farm's Condo Unitowners Insurance.

Townhome owners of Gilbert, State Farm has you covered.

State Farm can help you with condo insurance

Agent Linda Gomez Dyster, At Your Service

With this coverage from State Farm, you don't have to be afraid of the unanticipated happening to your most personal possessions. Agent Linda Gomez Dyster can help lay out all the various options for you to consider, and will assist you in constructing a wonderful policy that's right for you.

Gilbert condo owners, are you ready to find out what a State Farm policy can do for you? Call or email State Farm Agent Linda Gomez Dyster today.

Have More Questions About Condo Unitowners Insurance?

Call Linda at (480) 926-4280 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

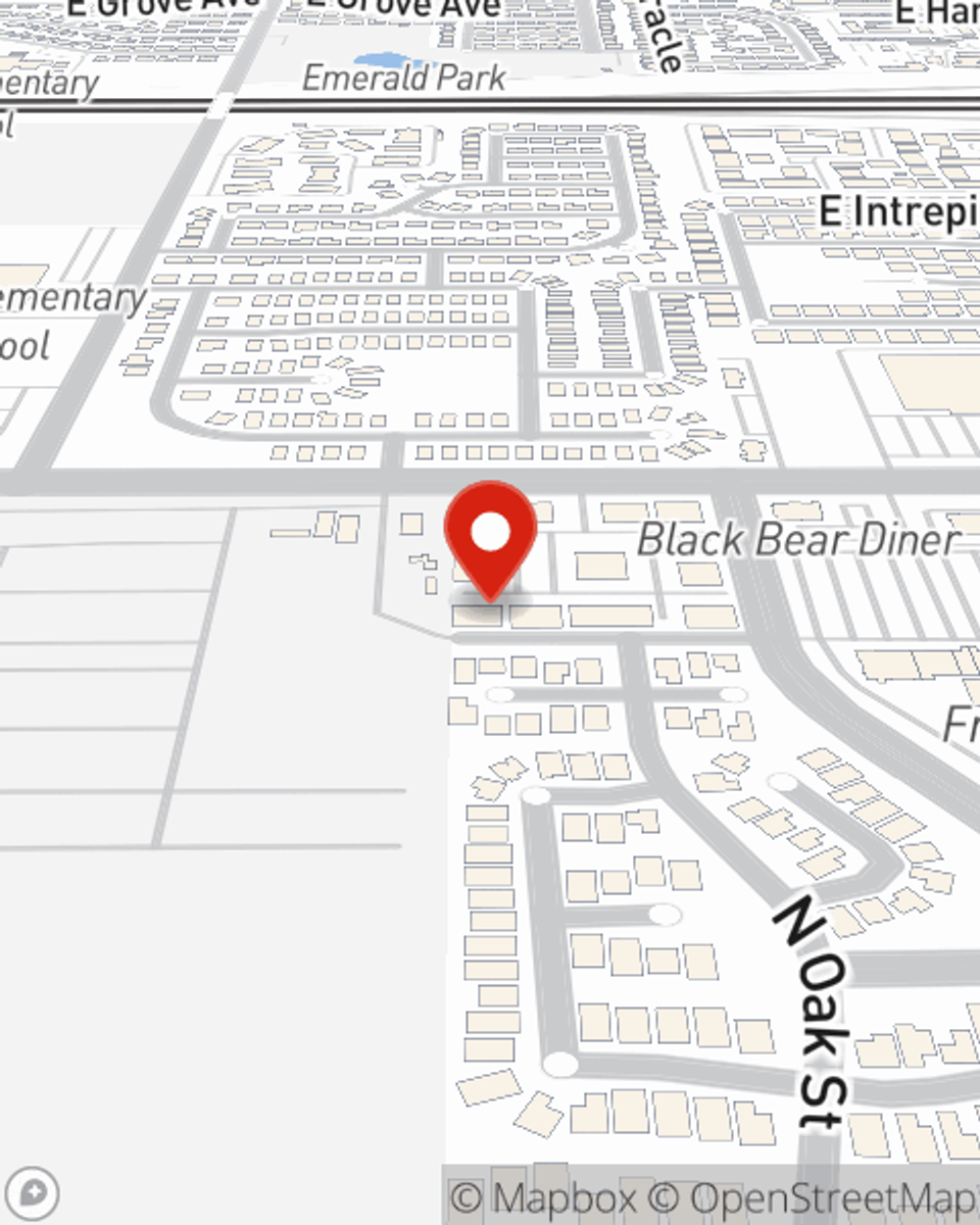

Linda Gomez Dyster

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.